By Tim Cronin and Antonia Herzog

Essential hospitals and health centers in all types of communities across the country are facing growing challenges in providing high-quality healthcare to patients, balancing increasingly complex energy needs, and the ongoing threat of extreme weather disruptions and damage.

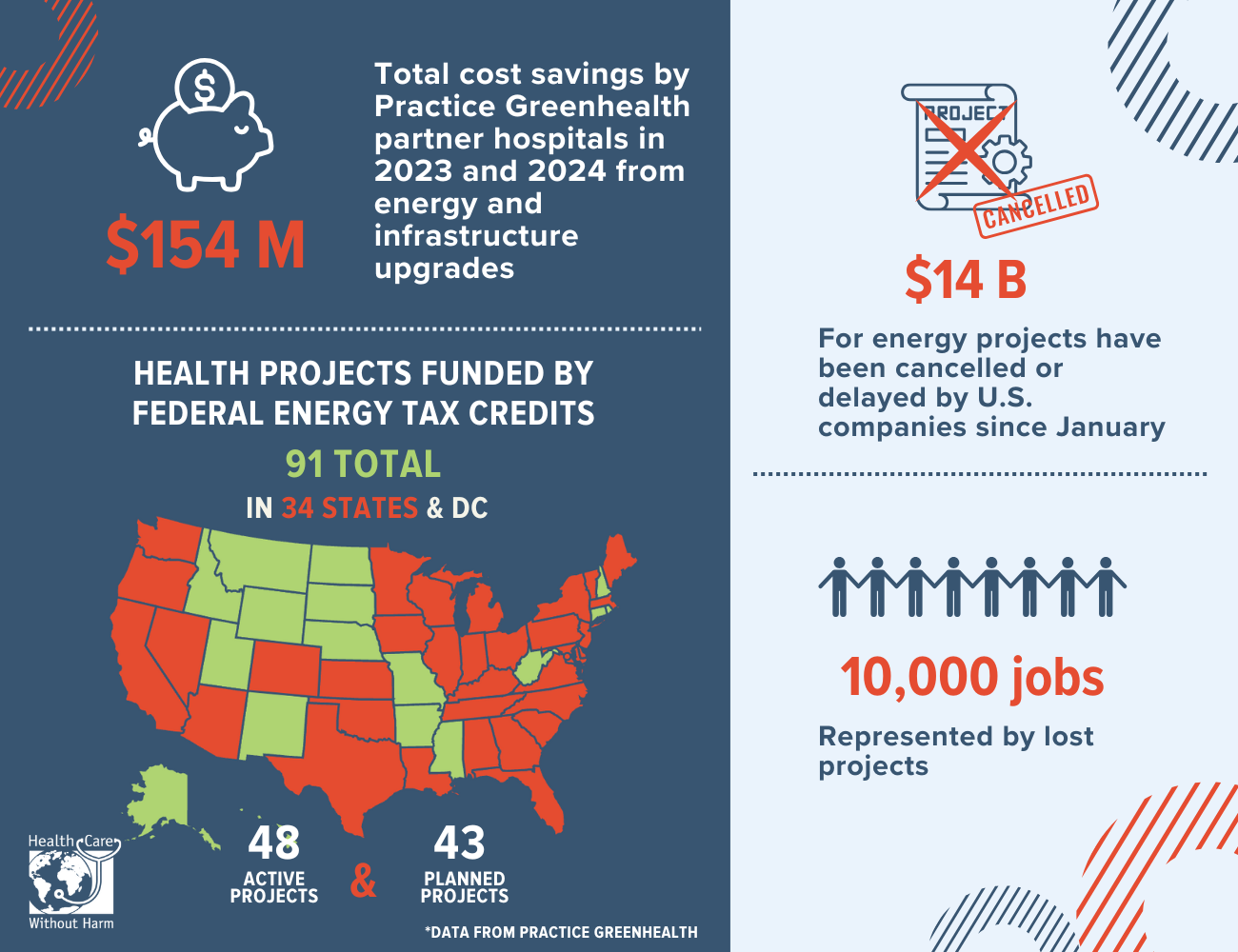

Federal energy tax credits established in 2022 that make critical energy infrastructure upgrades possible for nonprofit healthcare organizations are at risk of being rolled back under the budget reconciliation bill, which was just passed by the U.S. House in May 2025 and is currently being considered in the Senate.

These tax credits can unlock patient savings and health benefits by reducing healthcare energy costs, protecting health facilities from extreme weather, and ultimately supporting increased access for all patients to high-quality, affordable healthcare, regardless of zip code. However, the uncertainty around the continued availability of these tax credits has led healthcare facilities to hold on making critical investments in updating their energy infrastructure.

From incentives to savings: Energy tax credits boost health infrastructure

New data from Practice Greenhealth provides a unique view of the transformative potential of these tax credits to double the number of nonprofit hospitals and health centers investing in energy infrastructure critical to patient care, leading to tens of millions of dollars in annual savings.

Health Care Without Harm’s new Hospital Energy Tax Credit Use Analysis looks at examples of hospital use of federal energy tax credits paired with the elective/direct pay provision from 2023-2025, based on public case studies, media reports, interviews with hospitals and health centers, and anonymized data collected as part of the 2025 Practice Greenhealth Environmental Excellence Awards.

The analysis features 91 current and prospective energy projects at U.S. hospitals and health centers, representing the most comprehensive analysis to date on healthcare provider interest in these credits, and provides a number of key insights and trends, including:

Hospitals investing in energy efficiency, cogeneration systems, and other energy infrastructure upgrades – projects eligible for federal energy tax credits – saved over $154 million in 2023 and 2024 alone, according to data from nearly 1,000 applications to the Practice Greenhealth awards program.

Health facilities in every part of the country and all types of communities are accessing or want to access energy tax credits. Ranging from small rural facilities to major urban safety-net hospitals to multi-state nonprofit health systems, the analysis features information on existing facilities located across 34 states and Washington, D.C., with projects completed or under construction in 18 states.

For every hospital with an active project using federal energy tax credits, another is being considered. We found that 48 hospitals and health centers have completed or are currently constructing projects funded by these credits, while another 43 hospitals and health centers shared that they are exploring or planning such projects.

Health facilities are accessing these energy credits to fund new projects and address deferred maintenance on energy infrastructure. In many cases, without access to tax credits, critical hospital energy infrastructure upgrades would not happen or continue to be delayed by multiple years. Our data shows that hospitals and health centers have used these energy tax credits to pay for new technologies like on-site solar, microgrids, geothermal systems, electric vehicle charging infrastructure, and combined heat and power plant upgrades.

*This private analysis likely underrepresents accurate numbers as organizations are not required to disclose how they have accessed these provisions publicly. All data was shared voluntarily, suggesting that hospitals and patients are likely to benefit far more than we can know.

Powering resilience: Advancing emergency preparedness & healthcare access with federal tax credits

Health facilities are turning to energy tax credits to fund essential infrastructure upgrades that would otherwise be too costly to invest in now.

Margaret Mary Health in rural Indiana is leveraging federal energy tax credits to replace an aging and unreliable HVAC system with a state-of-the-art geothermal system.

The project initially aimed to save $300,000 with a tax credit covering 30% of project costs. This provided a six-year return on investment driven by long-term savings on the hospital's energy bills. In actuality, they were able to additionally leverage a domestic content bonus credit, increasing the tax credit available to 40%, and have now been paid $413,000.

With such favorable financials, the health center is able to reinvest further in community cancer care services in southern Indiana, and is building a new replacement hospital with a geothermal system.

Healthcare organizations are using federal energy tax credits to meet critical emergency preparedness needs for their facilities.

Valley Children’s Healthcare, located in the rural agricultural community of Madera, California, is installing a microgrid that allows the hospital to operate even during wildfires and power shutoffs. The $30 million system combines solar, fuel cell, and battery storage, and will power 80% of the hospital’s peak energy needs.

Federal energy tax credits, including the Domestic Content Bonus and the Low-Income Communities Bonus on the Investment Tax Credit, make this project possible by covering over 40% of the total cost to the hospital. Valley Children’s will save enough on energy over 25 years to cover the remaining capital cost, while significantly enhancing their facilities' resilience to extreme weather disasters.

of

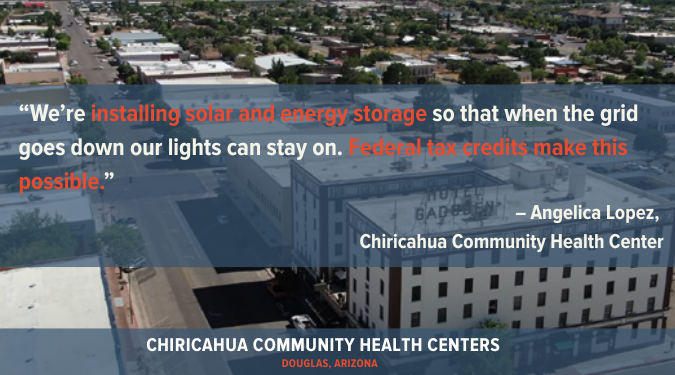

Rural community health centers are using federal energy tax credits to keep the lights on and invest more dollars into patient care.

Chiricahua Community Health Centers in Douglas, Arizona, experiences over 30 power outages a year and is using the tax credits for a resilient solar and battery storage project. The project will allow the health centers to keep the lights on for patients and reduce energy costs, allowing them to reinvest those dollars in the community and patient care.

In partnership with a community solar developer, Chiricahua was able to bring the total federal tax credit to 50% of the project's eligible costs, leveraging both the Investment Tax Credit and the Low-Income Communities Bonus Credit.

Hospitals are leveraging tax credits to invest in innovative patient care models, which would not be possible without them.

Boston Medical Center is using federal energy tax credits to launch a replicable and innovative project that supports patients facing higher energy bills. Called the Clean Power Prescription program, it allows doctors to “prescribe” power from an on-site solar facility to patients experiencing energy insecurity. Taking the form of monthly electricity credits, Clean Power Prescription improves patient well-being and advances the hospital’s commitment to supporting communities facing burdens from skyrocketing personal energy costs.

The Investment Tax Credit covers 60% of the project's $1.6 million cost, leveraging the Low-Income Communities Bonus Credit and the Energy Community Bonus Credit.

Critical window for action: Safeguarding access to federal energy tax credits in healthcare

While early adopters are proving what’s possible, much of the potential of federal energy tax credits to support the critical work of the health sector remains untapped. Thousands of hospitals and health centers, particularly in rural areas or those serving underserved and low-income populations, have yet to access these credits.

Part of the reason is that awareness and readiness to access these tax credits take time, especially given that they are just over two and a half years old. Many hospitals and health centers are still navigating what types of projects qualify, how to structure financing, and when to apply. As healthcare organizations weigh these decisions, uncertainty around the future availability of these provisions – and their potential to be cut by Congress – has significantly slowed the pace of new projects that would require the credits. Continued access to these financial tools is essential to ensure all communities, regardless of geography or income, benefit from a cleaner, more resilient healthcare system.

Take a deeper dive

In addition to the links provided above, information on the stories of healthcare providers leveraging the tax credits are available in the U.S. Department of Health and Human Services case studies.

Practice Greenhealth is the innovation hub scaling the work of Health Care Without Harm. It is the leading sustainable health care organization, delivering environmental solutions to more than 1,700 hospitals and health systems in the United States and Canada.